The Association of British Insurers (ABI) reiterated its stand on business interruption cover following the government intervention to ensure providers pay out to those with pandemic business interruption cover. The government assured policyholders yesterday (17 March) these particular claims will be accepted by insurers even though current business closures are voluntary and not mandated. Unprecedented The ABI commented: “The spread of coronavirus is unprecedented in modern times and we understand this is an incredibly difficult time for families and businesses. Related articles Finance adviser suspends broker fees Covid-19: Software houses release continuity plans Covid-19: Biba defends hiring Boris Johnson as speaker Travel brokers reveal mixed approach to coronavirus cover “Standard commercial insurance policies – the type the vast majority of businesses purchase – provide cover against a wide range of day to day risks including damage caused by fire, flood, theft and accidents involving employees.” A spokesperson detailed: “Insurers pay out £22m each day to firms through these policies, supporting millions of businesses across the UK each year. “Only a very small minority of businesses choose to buy any form of cover that includes local closure due to an infectious disease.” The ABI was criticised for the tone of its former statements yesterday by former Post editor and journalist David Worsfold, who wrote: “The statements from the ABI have been blunt, insensitive and totally lacking in awareness of how insurance is perceived.

The Association of British Insurers (ABI) reiterated its stand on business interruption cover following the government intervention to ensure providers pay out to those with pandemic business interruption cover. The government assured policyholders yesterday (17 March) these particular claims will be accepted by insurers even though current business closures are voluntary and not mandated. Unprecedented The ABI commented: “The spread of coronavirus is unprecedented in modern times and we understand this is an incredibly difficult time for families and businesses. Related articles Finance adviser suspends broker fees Covid-19: Software houses release continuity plans Covid-19: Biba defends hiring Boris Johnson as speaker Travel brokers reveal mixed approach to coronavirus cover “Standard commercial insurance policies – the type the vast majority of businesses purchase – provide cover against a wide range of day to day risks including damage caused by fire, flood, theft and accidents involving employees.” A spokesperson detailed: “Insurers pay out £22m each day to firms through these policies, supporting millions of businesses across the UK each year. “Only a very small minority of businesses choose to buy any form of cover that includes local closure due to an infectious disease.” The ABI was criticised for the tone of its former statements yesterday by former Post editor and journalist David Worsfold, who wrote: “The statements from the ABI have been blunt, insensitive and totally lacking in awareness of how insurance is perceived.

Government Statement re BI Cover – ABI insists very few have this cover. INSURANCE AGE

Government says insurers will cover pandemic but ABI insists this changes very little as most do not have this type of cover. Insurers will payout to firms for business interruption (BI) if they have pandemic cover and have been compelled to close due to government guidelines. Where the insurance would have kicked in if the government mandated closures it will now become active in response to the current guidelines Insurers have faced criticism, as has the government, after the Prime Minister Boris Johnson only recommended, instead of ordering, businesses close to help people avoid social contact amid the spread of the coronavirus. Related articles Covid-19: Mactavish calls on government to help insurers through crisis Finance adviser suspends broker fees Covid-19: Biba defends hiring Boris Johnson as speaker Covid-19: Software houses release continuity plans Some were concerned that BI would only kick in if the government mandated the order to close. The measure is part of a £330bn package announced by Chancellor Rishi Sunak designed to support the economy. This includes scrapping business rates for some organisations and increasing the loans available to SMEs. Claim Sunak stated in the now daily Covid-19 update: “Let me confirm that, for those businesses which do have a policy that covers pandemics, the government’s action is sufficient and will allow businesses to make an insurance claim against their policy.” He confirmed the government had reached an agreement with insurers on 17 March. Johnson said: “Insurers understand they have to pay out to those businesses.” The Association of British Insurers suggested earlier on that day that most business interruption policies would not cover firms for closures arising from the spreading coronavirus. The trade body indicated that this agreement would change very little as, unless customers have purchased the right insurance, they won’t be eligible to claim. A spokesperson said: “The Chancellor’s statement today is consistent with our statement this morning (17 March) where we said in the event businesses have the right cover, this type of notification could help make a claim. “But, as the Chancellor acknowledged, the vast majority won’t have purchased extended cover and this remains unchanged.”

Government says insurers will cover pandemic but ABI insists this changes very little as most do not have this type of cover. Insurers will payout to firms for business interruption (BI) if they have pandemic cover and have been compelled to close due to government guidelines. Where the insurance would have kicked in if the government mandated closures it will now become active in response to the current guidelines Insurers have faced criticism, as has the government, after the Prime Minister Boris Johnson only recommended, instead of ordering, businesses close to help people avoid social contact amid the spread of the coronavirus. Related articles Covid-19: Mactavish calls on government to help insurers through crisis Finance adviser suspends broker fees Covid-19: Biba defends hiring Boris Johnson as speaker Covid-19: Software houses release continuity plans Some were concerned that BI would only kick in if the government mandated the order to close. The measure is part of a £330bn package announced by Chancellor Rishi Sunak designed to support the economy. This includes scrapping business rates for some organisations and increasing the loans available to SMEs. Claim Sunak stated in the now daily Covid-19 update: “Let me confirm that, for those businesses which do have a policy that covers pandemics, the government’s action is sufficient and will allow businesses to make an insurance claim against their policy.” He confirmed the government had reached an agreement with insurers on 17 March. Johnson said: “Insurers understand they have to pay out to those businesses.” The Association of British Insurers suggested earlier on that day that most business interruption policies would not cover firms for closures arising from the spreading coronavirus. The trade body indicated that this agreement would change very little as, unless customers have purchased the right insurance, they won’t be eligible to claim. A spokesperson said: “The Chancellor’s statement today is consistent with our statement this morning (17 March) where we said in the event businesses have the right cover, this type of notification could help make a claim. “But, as the Chancellor acknowledged, the vast majority won’t have purchased extended cover and this remains unchanged.”

Covid-19: ABI admits few will be covered for BI

The government advised leisure businesses to close voluntarily prompting a public backlash that firms won’t be able to claim for business interruption as it isn’t a closure order. The vast majority of companies won’t have bought cover that protects them in the event of business interruption caused by the coronavirus, according to experts. The Association of British Insurers (ABI) confirmed to Insurance Age: “Irrespective of whether or not the Government order closure of a business, the vast majority of firms won’t have purchased cover that will enable them to claim on their insurance to compensate for their business being closed by the Coronavirus.” Yesterday (16 March) the government recommended that people stay away from pubs, restaurants and bars and called on people to avoid all non-essential contact. People have also been guided to work from home where they can. However it did not order the closure of these public spaces. The trade body for insurers was responding to public speculation that the insurance industry was being protected by the government from paying out with many arguing that if closures were mandated that business interruption cover would kick in. Wrong According to the ABI this is a fallacy. The spokesperson continued: “Standard business interruption cover – the type the majority of businesses purchase – does not include forced closure by authorities as it is intended to respond to physical damage at the property which results in the business being unable to continue to trade.” Some commentators referred to Boris Johnson’s appearance at the British Insurance Brokers’ Association (Biba) conference last year. Biba defended its decision to hire Johnson as a speaker and committed to helping its brokers navigate this period of uncertainty. Perspective A spokesperson commented: “Our decision to have Boris Johnson speak at our 2019 conference was taken to provide an interesting and relevant perspective from a then backbench politician who was highly influential in the UK’s decision to leave the EU. What we are facing now as a sector is unprecedented. “The issues that the businesses of the UK are facing are real and very concerning. Our team is currently talking with other bodies and Treasury about the response of the industry and the advice we can give to brokers and their customers.” She referred brokers to the guidance the body had already produced: “We have already published advice to members to help them manage customer queries but every policy wording is different and the extensions to cover that may include pandemic situations are optional covers and also very in their application. We will do what we can to add clarity.” Extensions? For some clients the picture may be brighter if they have bought a suitable business extension. The ABI spokesperson explained: “A small minority of typically larger firms might have purchased an extension to their cover for closure due to any infectious disease. In this instance an enforced closure could help them make the claim, but this will depend on the precise nature of the cover they have purchased so they should check with their insurer or broker to see if they are covered.” Some insurers have already responded to questions about how they will deal with business interruption claims. Axa, which also pulled its attendance at Biba’s May conference due to the virus, confirmed that unless Covid-19 was specified on documents it would not cover it. NIG also stated that Covid-19 was not listed on its documents. Other providers including Zurich, RSA, and Ageas said they would deal with claims on a case-by-case basis and urged clients and brokers to check wordings.

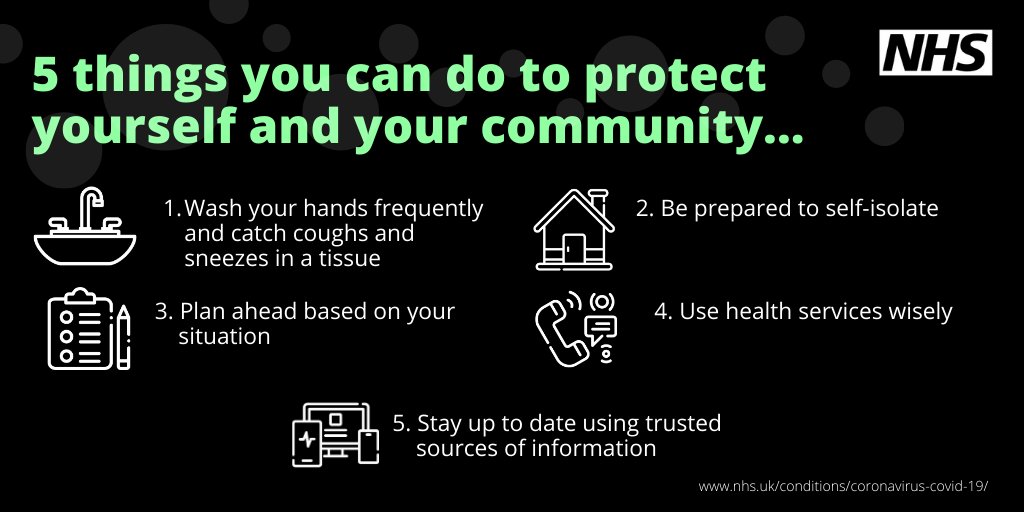

COVID 19 Restrictions

Dobson and Hodge Ltd take the health and well being of our staff, their families and our customers very seriously so we will endeavour to help in any way to work around the restrictions that have to be implemented by the Government.

Dobson and Hodge Ltd take the health and well being of our staff, their families and our customers very seriously so we will endeavour to help in any way to work around the restrictions that have to be implemented by the Government.

Our offices on Thorne Road are open for normal business hours but staffing numbers and availability may vary due to homeworking and self isolation.

We will limit visits and work under the guidance of our customers around the urgency to handle claims and other insurance matters in person.

Maintaining our constant commitment to the highest service levels will be upheld and we hope you will understand if calls are diverted to our colleagues working from home mobiles with possible limited data and broadband speeds.

The pandemic and the restrictions may go on for some weeks and possibly months and we can only wish our customers and the general public our goodwill and hopes for absolute minimum disruption and personal suffering.

CENTENARY CELEBRATIONS AT DONCASTER DEAF TRUST POSTPONED

The celebration on Saturday 20th June 2020 has had to be cancelled because of the current COVID 19 restrictions. This is a great sadness to our staff and friends who were attending. Their efforts will not be in vain as a new date will be arranged as soon the current very serious situation comes to an end.

The celebration on Saturday 20th June 2020 has had to be cancelled because of the current COVID 19 restrictions. This is a great sadness to our staff and friends who were attending. Their efforts will not be in vain as a new date will be arranged as soon the current very serious situation comes to an end.

Compass Conference Award Winners

DOBSON & HODGE LTD were honoured with a special award today at the COMPASS CONFERENCE. Ailsa Watson & Alastair Duncan were in attendance to accept the award. Ailsa is beaming after receiving the special acknowledgement from Ex England Cricket Captain & Chair, Andrew Strauss.

DOBSON & HODGE LTD were honoured with a special award today at the COMPASS CONFERENCE. Ailsa Watson & Alastair Duncan were in attendance to accept the award. Ailsa is beaming after receiving the special acknowledgement from Ex England Cricket Captain & Chair, Andrew Strauss.